CONTACT US:

425-236-6777

February 2021 is a Seller's market!

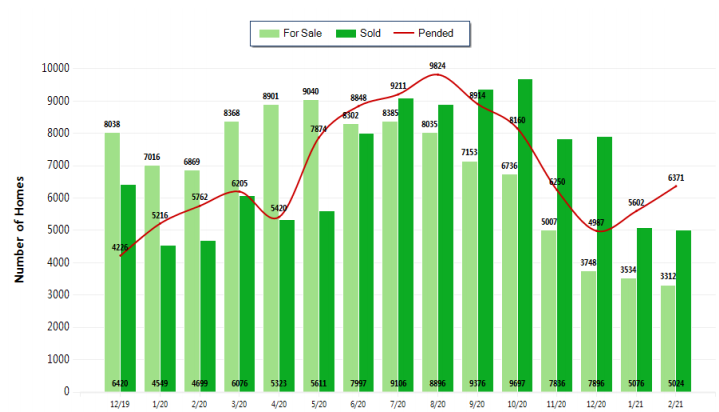

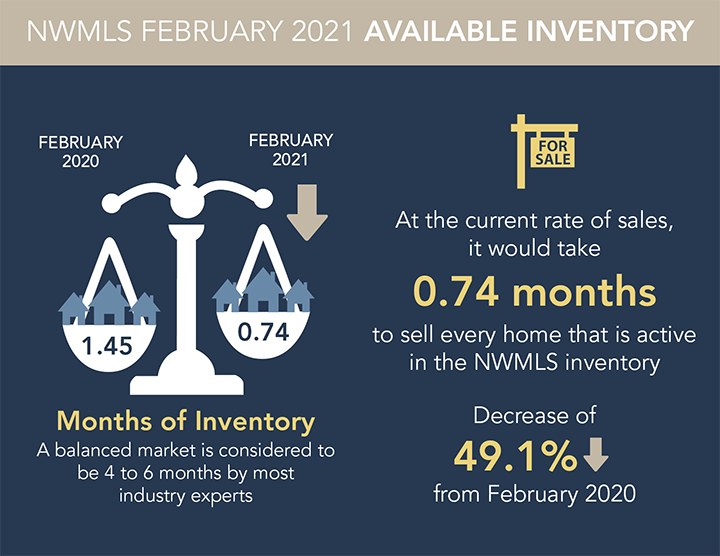

The number of for sale listings was down 51.8% from one year earlier and down 6.3% from the previous month. The number of sold listings increased 6.9% year over year and decreased 1% month over month. The number of under contract listings was up 13.7% compared to previous month and up 10.6% compared to previous year. The Months of Inventory based on Closed Sales is 0.7, down 54.7% from the previous year. The Average Sold Price per Square Footage was up 5.6% compared to previous month and up 19% compared to last year. The Median Sold Price increased by 5.1% from last month. The Average Sold Price also increased by 4.8% from last month. Based on the 6 month trend, the Average Sold Price trend is "Neutral" and the Median Sold Price trend is "Appreciating". The Average Days on Market showed a neutral trend, a decrease of 48.9% compared to previous year. The ratio of Sold Price vs. Original List Price is 103%, an increase of 4% compared to previous year.

Property Sales (Sold)

January property sales were 5024, up 6.9% from 4699 in February of 2020 and 1% lower than the 5076 sales last month.

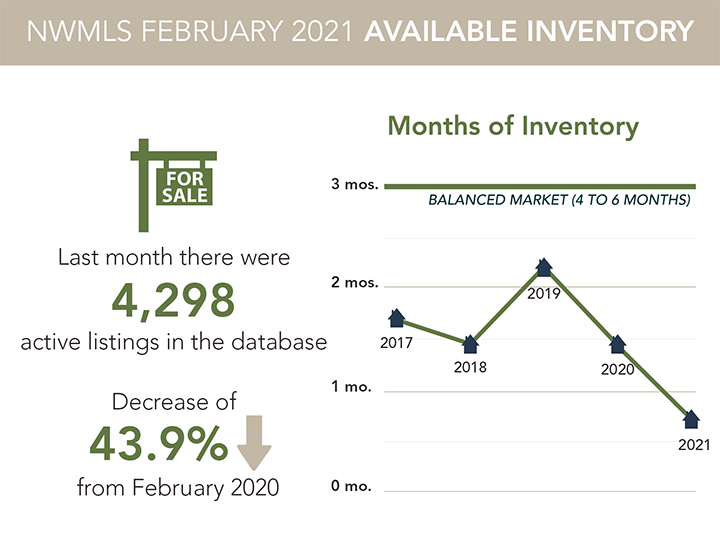

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 3557 units of 51.8%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventory is down 5.7% compared to the previous month.

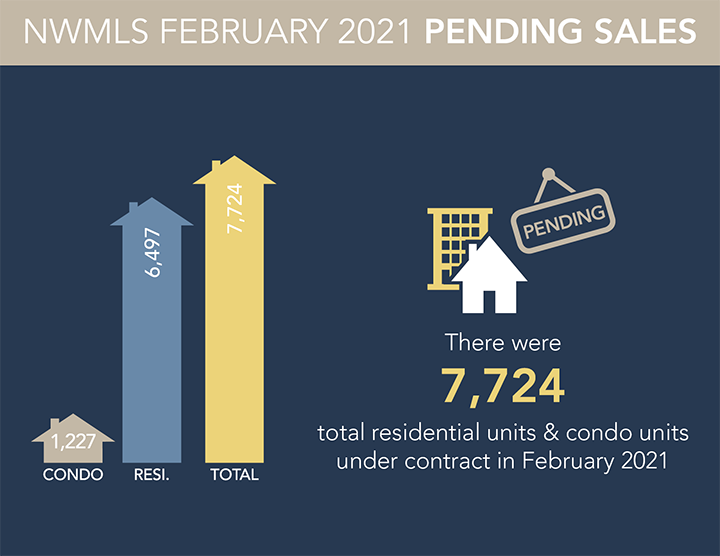

Property Under Contract (Pended)

There was an increase of 13.7% in the pended properties in February, with 6371 properties versus 5602 last month. This month's pended property sales were 10.6% higher than at this time last year

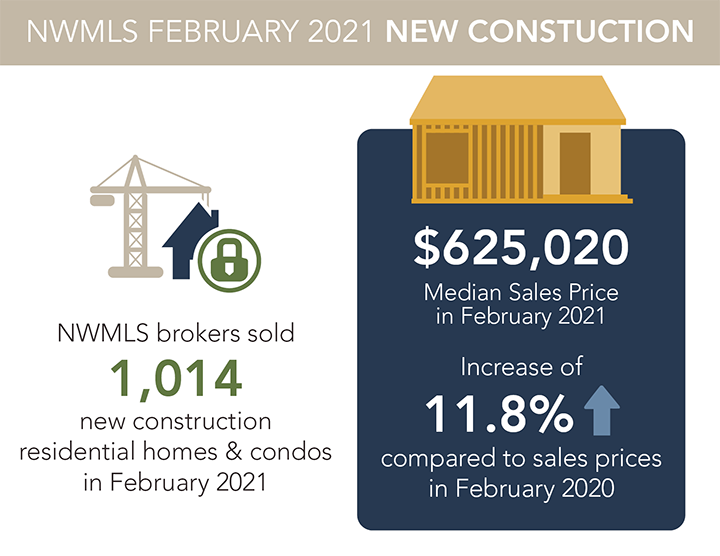

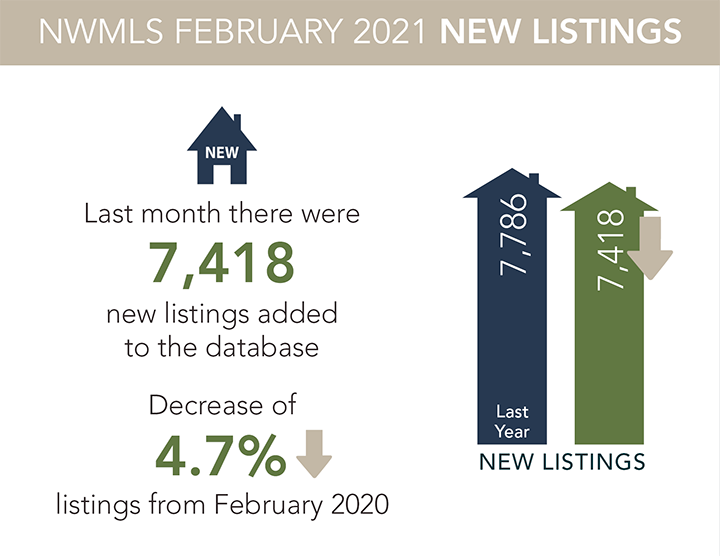

Housing activity during February remained hot around much of Washington state despite significant accumulation of lowland snow over the Valentine’s Day weekend. It’s amazing how close the February numbers are when compared to February 2020, which was, of course, right before our world changed. Despite our similarly lousy February weather, the data show that the market continues to be hot, with residential inventory very tight and median prices rising by double digits across most of our counties. Northwest MLS figures show brokers added a similar number of new listings of single family homes and condos last month (7,418) as a year ago (7,786), for a difference of 368 properties (down 4.7%). For residential units (excluding condos), there was a 6.8% year-over-year (YOY) drop. Total active listings of single family homes declined nearly 44% from a year ago. The selection of single family homes fell more than 51% while condo inventory rose 7.9%. A decline in listing volume this year should not surprise anyone.

There are only about three weeks of supply (0.74 months) of inventory in the MLS database, which covers 26 counties. For residential only (excluding condos), the shortage is more pronounced at only 0.67 months’ supply. Condominium shoppers will find more selection, with inventory up 7.93% from a year ago, and more than a month of supply (1.12 months). While pending condominium sales were down slightly in King County (-0.56%), it’s worth noting that several urban neighborhoods, including Queen Anne, Downtown Seattle, and Ballard performed better than expected. That suggests that there may not be the mass exodus from the core urban areas that many have been predicting. Nearly six of every 10 pending sales of condos took place in King County last month, according to the Northwest MLS report. Pending activity nearly match the year ago totals for that county (716 versus 720). Pending sales (mutually accepted offers) were up sharply in several Seattle neighborhoods, including Queen Anne (48.8%), West Seattle (42.1%), and Ballard/Green Lake (32.5%). Even the Downtown/Belltown area registered an uptick (4.8%).

Neither the snowstorm that hit the region nor the jump in mortgage rates deterred buyers who were still out in force last month. The slight increase in mortgage rates created a mini surge of sales intensity. Freddie Mac reported an average rate of 3.02% for a 30-year fixed-rate mortgage for the week ending March 4. That’s up five basis points from the previous week, and the first time since July 2020 that the benchmark mortgage rate climbed above 3%. Despite rates edging up and inclement weather during much of February, eight counties in the Northwest MLS report showed year-over-year gains in pending sales: Adams, Douglas, Grant, Kitsap, Lewis, Pacific, San Juan, and Walla Walla. System-wide, there were 7,724 pending sales in February, a YOY drop of 7.5%, but compared to January when brokers reported 7,394 sales, the pending volume increased 4.5%.

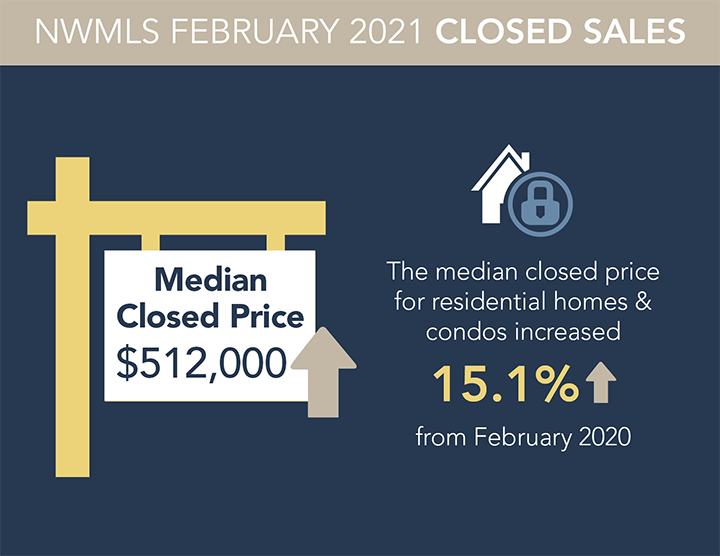

Within King County, suburban markets such as Renton, Burien, and interestingly, West Seattle (given the bridge issue), continued to see significant sales activity in February, but so too did more urban markets like Madison Park/Capitol Hill, Ballard/Green Lake, Queen Anne, and Magnolia, all of which reported sizable increases in home sales. Of the 30 neighborhood areas the MLS tracks within King County, thirteen of them showed year-over-year increases in pending sales. Like last year, before we knew what was just around the corner, buyer demand is high. There continues to be opportunities for buyers seeking condos, and median prices are more stable, so that’s also good news for buyers. On the residential side (excluding condos), more and more multiple offer situations are happening. With things opening up, and open house restrictions eased to allow more people at one time, brokers are also spending a good amount of time preparing their sellers to get comfortable with having people in their homes and to safely facilitate viewings, as well as managing and analyzing all the offers. Northwest MLS member-brokers reported 5,812 closed sales during February for a 10.4% increase over the year-ago total of 5,265 closings. The median price on last month’s completed sales jumped more than 15% from a year ago, increasing from $445,000 to $512,000. Twenty of the 26 counties in the report showed double-digit YOY price gains. Continuing low interest rates, jobs, and lifestyle changes are driving the real estate market in multiple offers. Prepared, aggressive buyers are winning the competition for homes. Smart buyers are making substantial offers to sellers prior to the offer review date, and sellers are considering them. March historically marks the beginning of an eight-month primetime real estate market. After an intense winter in the local real estate market, more new resale listings are on the horizon. The intensity we’re seeing should come down slightly as more available homes enter the market, but we have to play catch-up with pent-up buyer demand first.

Interview with Dan Golden of Cornerstone Home Lending by George Moorhead of Bentley Properties

George Moorhead of Bentley Properties Interviews Dan Golden of Cornerstone Home Lending To Give You A Deeper Insight About What You Need To Know in Today's Real Estate Market

For more Real Estate News and Advice, please tune in to our Facebook live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com